2022 tax brackets

18 rows 2022 tax brackets are here. Free tax filing software will find your tax bracket for 2021 with guaranteed accuracy.

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Compare your take home after tax and estimate.

. 13 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. Over 83550 but not over 178150. For 2018 they move down to the 22 bracket.

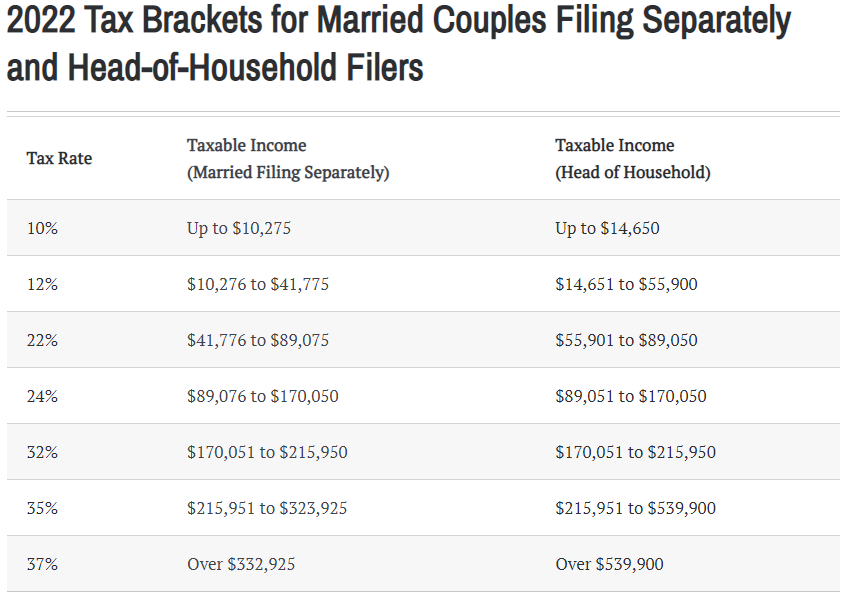

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. There are seven federal income tax rates in 2023. 16 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits.

2055 plus 12 of the excess over 20550. We Take Pride In Providing Exceptional Service Tailored To Your Businesss Needs. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71.

Over 20550 but not over 83550. 7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your. Taxable income between 10275 to 41775.

Taxable income up to 10275. 2022 New Jersey Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and.

37 for individual single taxpayers with incomes greater than. There are seven federal tax brackets for the 2021 tax year. 10 of taxable income.

April 17 2023 Single. Your 2021 Tax Bracket To See Whats Been Adjusted. Trending News Abbott recalls more baby.

Heres a breakdown of last years. Below are the new brackets for both individuals and married coupled filing a joint return. Tax on this income.

1 day agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said. 8 hours agoFor 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. Ad Compare Your 2022 Tax Bracket vs.

75901 to 153100 28. Ad Weve Provided Accurate Reliable Corporate Tax Services For Over 30 Years. 10 12 22 24 32 35 and.

11 hours agoTax brackets can change from year to year. They dropped four percentage points and have a fairly. Discover Helpful Information And Resources On Taxes From AARP.

Guaranteed maximum tax refund. Federal Income Tax Bracket for 2022 filing deadline. 19 cents for each 1 over 18200.

This means that these brackets applied to all income. 8 rows 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax. The IRS recently released the new tax brackets and standard deduction amounts for the 2022 tax year the tax return youll file in 2023.

9615 plus 22 of. The agency says that the Earned Income. Read on to see whats in store for 2023.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Lets review the standard deduction. Get help understanding 2022 tax rates and stay informed of tax.

Each of the tax brackets income ranges jumped about 7 from last years numbers. 13 hours ago2022 tax brackets for individuals. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing.

From 6935 for the 2022 tax year to 7430 in 2023. Resident tax rates 202223. 14 hours agoHere are the newly released brackets for individuals and married couples filing for a tax return according to the IRS.

Taxable income between 41775 to 89075. Ad Free tax filing for simple and complex returns. And the alternative minimum tax exemption amount for next.

77400 to 165000 22. Americas tax brackets are changing thanks to inflation.

Tax Brackets Will Be Higher In 2022 Due To Surging Inflation Irs Says Fox Business

Analyzing Biden S New American Families Plan Tax Proposal

What Is The Difference Between The Statutory And Effective Tax Rate

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

How Nc S New Tax Cuts Will Save Taxpayers Billions

How Do Tax Brackets Work And How Can I Find My Taxable Income

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Tax Rates Tax Planning Solutions

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2022 Tax Brackets Internal Revenue Code Simplified

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Tax Changes For 2022 Including Tax Brackets Acorns

Corporate Tax Rate Schedule Tax Policy Center